What the Heck is DLMM and DAMM v2?

Alright, let’s break down what’s going on in the world of DeFi on Solana—specifically with a project that’s making some serious waves: Meteora.

If you’ve been poking around in Solana DeFi recently, you might’ve seen mentions of “DLMM” and “DAMM v2” getting tossed around like everyone just instinctively knows what they mean. But if you’re sitting there going, “I kinda get it, but not really…” — you’re not alone. That was me too, until I fell down the rabbit hole.

Let’s talk about it.

🚀 A Quick Backstory on Meteora

Meteora didn’t just come out of nowhere. It actually started life as Mercurial back in 2021. It had some decent traction, but let’s be real—DeFi moves fast, and Mercurial hit a few snags. So in 2023, the team hit the reset button. Rebrand. Refocus. Boom—Meteora was born.

One of the brains behind the relaunch? Ben Chow, who also co-founded Jupiter, another heavyweight in the Solana ecosystem. Safe to say, the guy knows what he’s doing. The team’s mission with Meteora was clear: build smarter, more flexible liquidity tools for Solana and make it easier (and more profitable) for LPs to stay sticky.

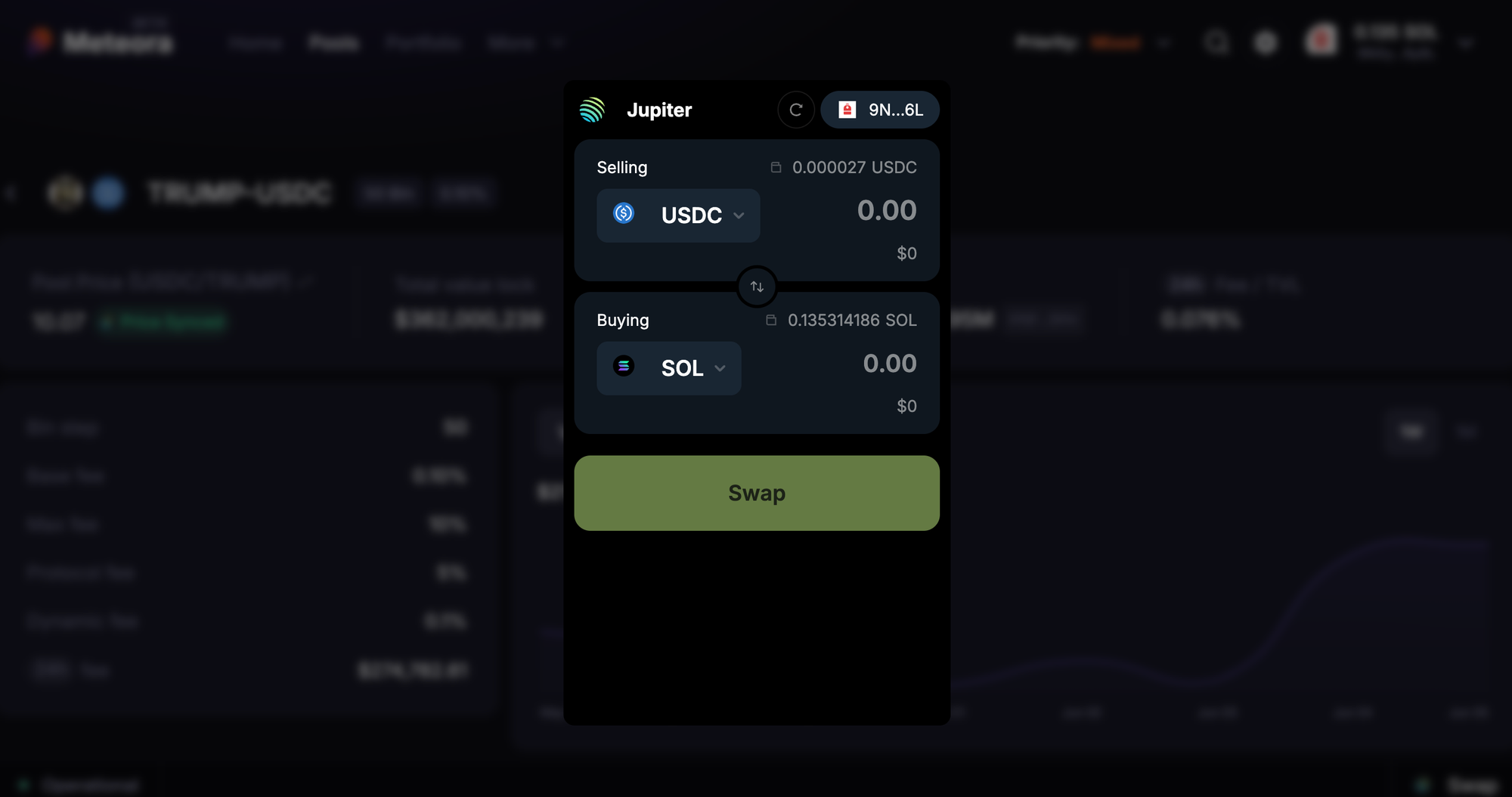

My favorite part about this is there's a Jupiter logo on the Meterora site in the lower corner. You can pop it open and swap tokens via Jupiter right there in line without having to leave.

🤯 So What’s DLMM?

DLMM stands for Dynamic Liquidity Market Maker. Imagine the OG Uniswap-style pools, but with a serious upgrade.

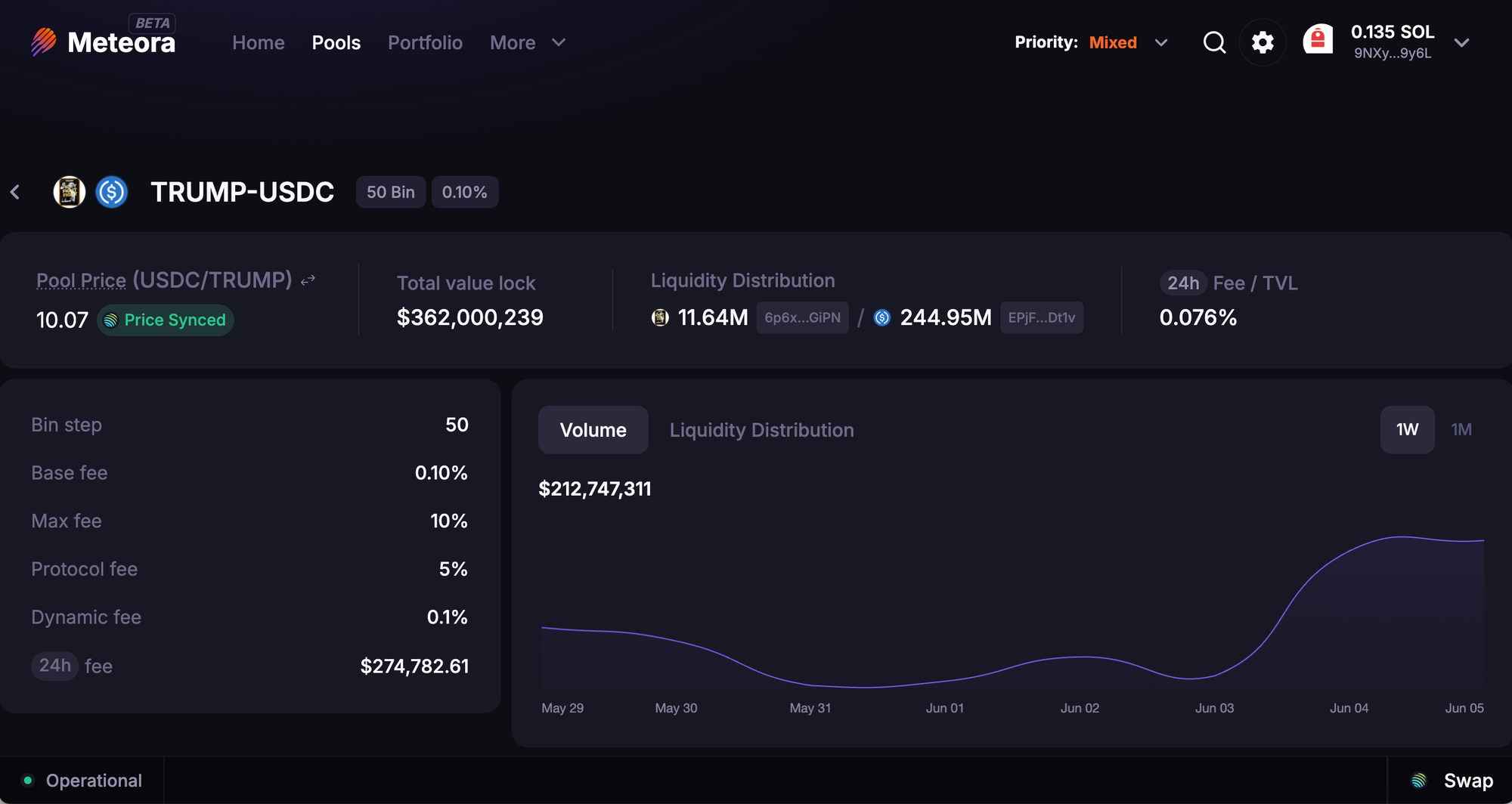

Instead of your liquidity being spread thin across the entire price range, DLMM chops it up into bins. These bins let you target specific price levels where you think the action’s gonna be—and that means more concentrated trades, less slippage, and better fees for you.

And if that’s not slick enough, the fees themselves can adjust based on market volatility. Wild, right?

In short: DLMM lets you be smarter with your liquidity and get rewarded for it.

🔧 And DAMM v2?

DAMM v2 is kinda like DLMM’s overachieving cousin.

It’s a Dynamic Automated Market Maker, but with a twist—it connects liquidity pools with lending protocols. So your assets don’t just sit there waiting for trades—they can also be loaned out, earning you passive interest while you’re farming swap fees.

Capital efficiency on steroids.

📊 Fast Facts About Meteora in 2025

Let’s throw some numbers around for context. Meteora is not some niche tool anymore—it’s one of the top DEXs on Solana right now:

- 💸 $183+ Billion in lifetime trading volume

- 🧠 573+ supported assets across 6,300+ markets

- 📈 In January alone? $39.9 Billion traded

- 🔐 Over $1.1 Billion in Total Value Locked (TVL)

- 📊 DLMM and DAMM v2 pools now dominate Solana DeFi

And here’s the kicker: Meteora has done all this without being flashy. No billboard ads. Just solid tech and good ol’ word of mouth.

💰 How to Earn MET Points (and Prep for the Airdrop)

You’ve probably heard whispers about MET Points and an upcoming airdrop. Yep—it’s happening, and it’s probably going to be one of the more generous ones in Solana DeFi.

Here’s how you earn MET Points:

- 🧮 Provide liquidity in DLMM pools → 1 MET point per $1 TVL per day

- 💵 Generate trading fees → 1,000 MET points per $1 of fees

- 🏦 Use vaults and earn yield passively

- 🗳️ Participate in governance if you’re feeling DAO-ish

Points should be viewable on Meterora soon. There are some third party tools floating around that show you points but nothing has been confirmed by the Meterora team.

Final Thoughts: Is This the Future of DeFi on Solana?

Honestly? It might be.

What I love about Meteora is it’s not trying to reinvent the wheel—it’s making the wheel way more efficient. DLMM and DAMM v2 are about working smarter, not just chasing yield. If you’re serious about building long-term value in Solana DeFi, it’s time to start paying attention to how liquidity actually works—and Meteora is a solid place to start.

So go start farming MET Points. Experiment with a DLMM pool. And if you’re like me, you might just become a bit addicted to this new flavor of DeFi.

Catch you in the bins. 🫡